News

Lotus Institute

USD Weakens, Gold Hits New High – Global Inflation Pressure Mounts

Release Time: 10:00 AM, April 17, 2025

Publisher: Mr. Tony

MARKET OVERVIEW

-

Stock Market:

-

Vietnam: The market continued to decline and temporarily paused around the 1,210-point level with reduced liquidity, indicating cautious cash flow after several supportive sessions. The current movement reflects a correction following a rapid recovery. The market needs more time to explore supply and demand to find a balance. The index is expected to test the support zone of 1,200 points in the upcoming sessions. If it holds, the market may recover and fluctuate within the 1,200 – 1,250 range.

-

U.S.: The U.S. market dropped sharply due to concerns over U.S.-China trade tensions. The Nasdaq lost 3.1%, the S&P 500 fell 2.2%, and the Dow Jones declined 1.7%. Nvidia suffered a $5.5 billion loss due to export restrictions to China. The Fed Chair warned of inflation risks and slowing growth, making investors more cautious.

-

Forex:

-

EUR/USD shows a short-term downward correction trend. Today, consider taking short positions with the daily resistance zone at 1.14000.

-

Gold:

-

XAU/USD maintains a strong upward trend, continuously setting new peaks. Support zone at 3000.

-

Oil:

-

XTI/USD is in an upward trend. Today, consider taking long positions with daily support at 61.50.

-

Crypto:

-

BTC is trading around 84,000 - 85,000 with no clear trend. Limit trading today.

TRADING PLAN

-

BTC:

-

Trend: Bearish

-

Recommendation: Sell at 84,000, stop loss at 86,000, take profit at 82,000-80,000.

-

-

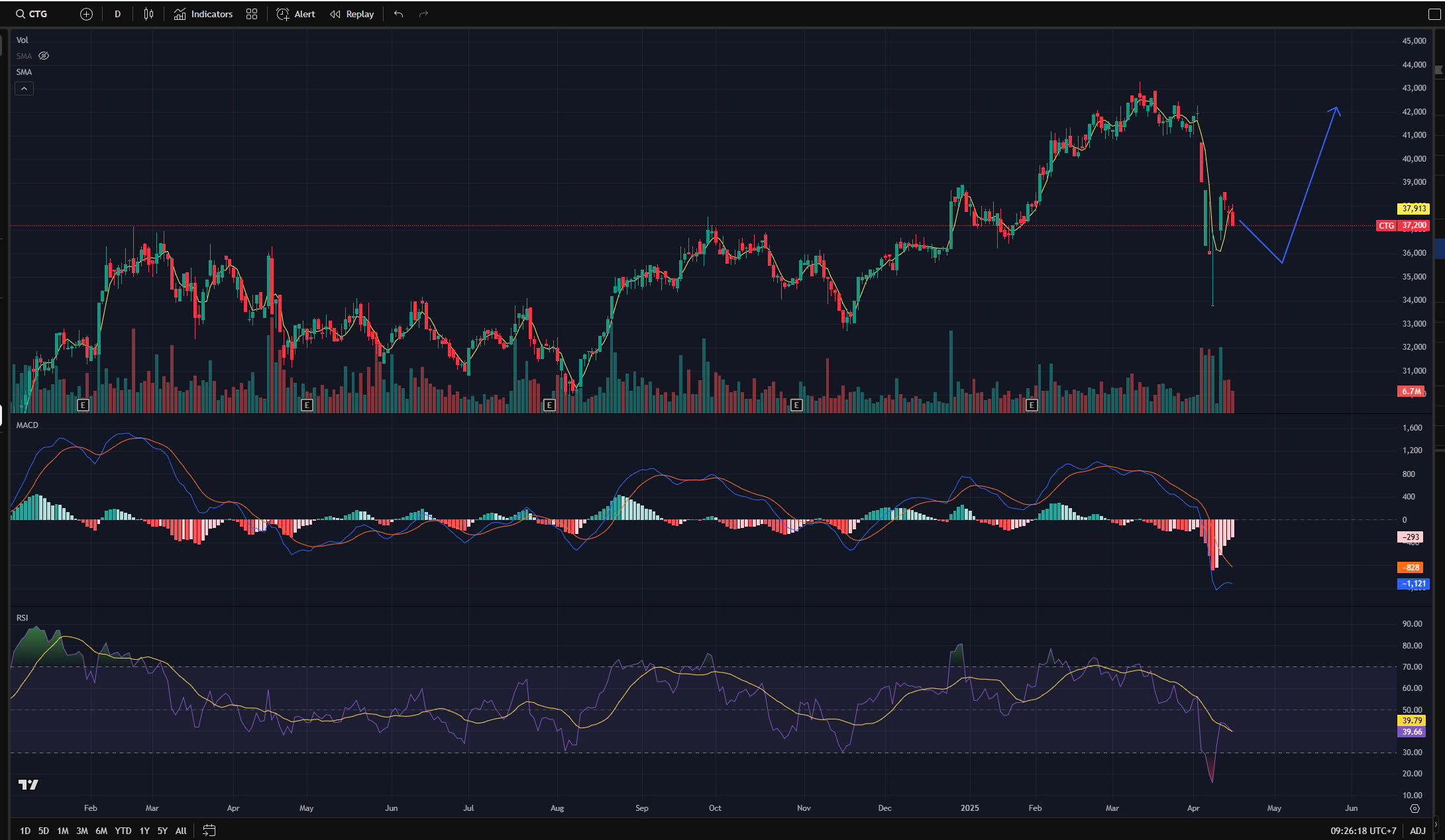

Vietnamese Stocks (CTG):

-

Recommendation: Wait to buy CTG (April 17, 2025) at 35,600 - 36,600 VND.

-

Target 1: 39,500 VND | Target 2: 42,300 VND | Stop loss: 34,400 VND.

-

-

EUR/USD:

-

Trend: Short-term bearish

-

Recommendation: Sell at 1.13753, stop loss at 1.14053, take profit at 1.13153.

-

KEY EVENTS TODAY

-

12:30 AM (UTC):

-

USD: Fed Chair Powell's speech.

-

-

5:45 AM (UTC):

-

NZD: Quarterly CPI (Consumer Price Index)

-

Actual: 0.7% | Forecast: 0.5%

-

-

-

8:30 AM (UTC):

-

AUD: Employment Change

-

Actual: 40.2K | Forecast: -52.8K

-

-

AUD: Unemployment Rate

-

Actual: 4.2% | Forecast: 4.1%

-

-

-

7:15 PM (UTC):

-

EUR: Main Refinancing Rate

-

Actual: 2.40% | Forecast: 2.65%

-

-

EUR: Monetary Policy Statement

-

-

7:30 PM (UTC):

-

USD: Unemployment Claims

-

Actual: 225K | Forecast: 223K

-

-

-

7:45 PM (UTC):

-

EUR: ECB Press Conference

-

DISCLAIMER

-

The above analysis represents the personal views of analyst Tony from Lotus and should not be considered as a basis for actual market participation.

-

Lotus only provides technical trading analysis and trading education for students.

-

Lotus does not represent any securities company or asset management firm.

-

Lotus does not manage clients' funds.