News

Lotus Institute

Shocking: USD in Free Fall Under Massive Spending Pressure, Gold Prices Surge, US Stocks Still Hit Record Highs!

Release Time:

10:00 AM, July 1, 2025

Published by:

Mr. Leon

Market Overview

1. Stock Markets:

-

Vietnam Market:

The market continues to rise but within a narrow range; lower liquidity suggests weak supply and hesitant capital. The previous uptrend remains supportive, especially after breaking above 1,372 points. Current signals suggest further upside potential in the next session. -

US Market:

The trading session on June 30, 2025, closed the first quarter strong. The S&P 500 (SPY) climbed to 6,204.95, up 31.88 points (+0.5%); Nasdaq rose 0.5% to 20,369.73; and Dow Jones (DIA) gained 275.50 points (+0.6%) to 44,094.77. Optimism around trade negotiations — especially after Canada dropped digital taxes on US firms — and expectations of a Fed rate cut fueled the rally.

2. Forex:

-

GBP/USD: Uptrend. Buy positions are suggested today. Daily support: 1.37000

-

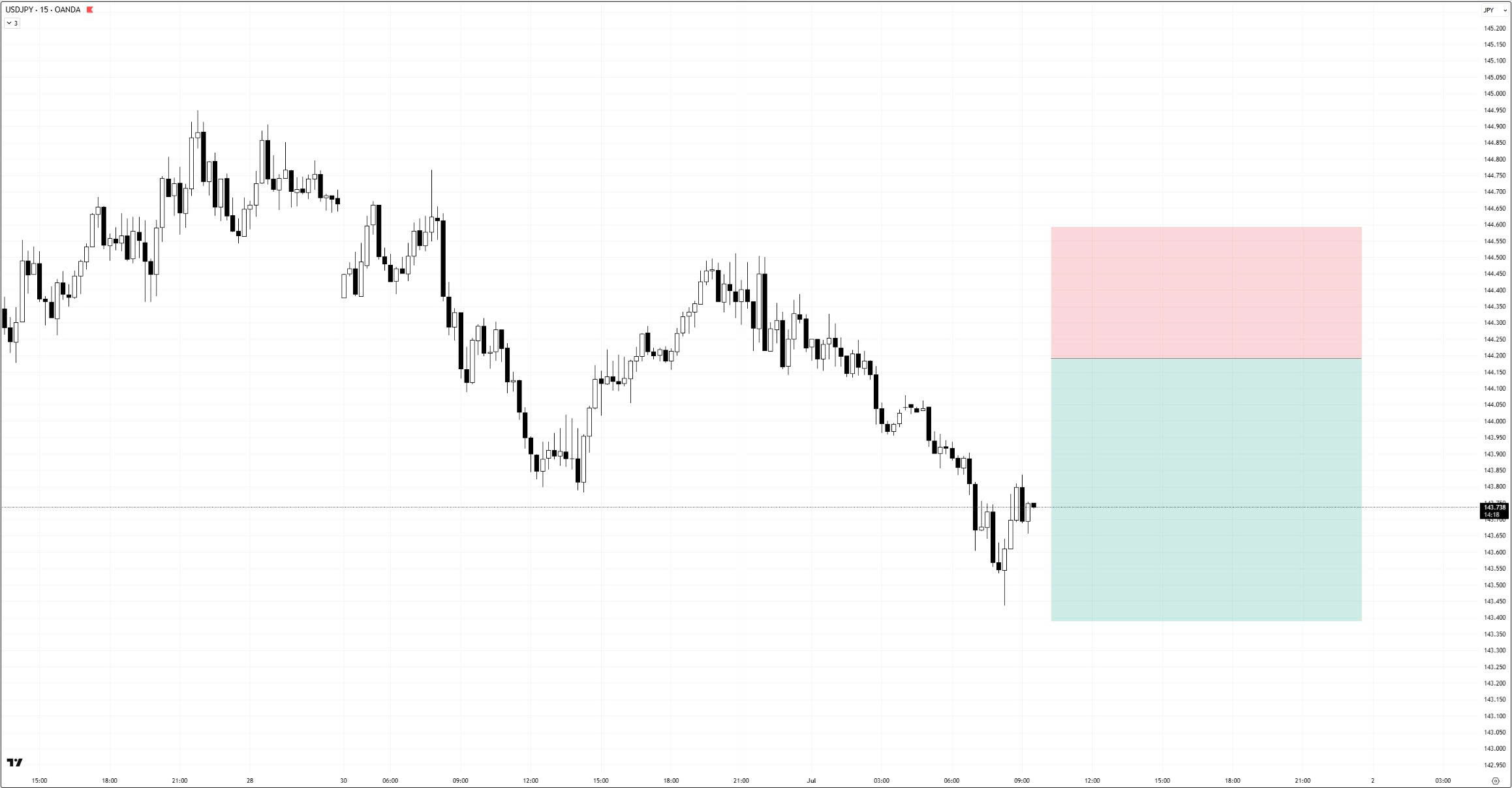

USD/JPY: Downtrend. Sell positions are suggested today. Daily resistance: 144.200

3. Gold:

-

Current price: $3,319.55/oz, up approximately +0.5% on the day

-

Bullish factors:

-

The USD weakens, near its lowest in 3 years due to concerns over a $3.3 trillion spending and tax cut package under Senate discussion

-

Ongoing trade tensions and safe-haven demand support gold

-

-

Short-term trend:

-

Gold may continue its upward momentum, awaiting US jobs data later this week — a key driver for Fed rate cut expectations

-

4. Oil:

XTI/USD lacks a clear trend — trading should be limited

5. Bitcoin:

-

Current price: Around $107,740 according to the CME BTC index, slightly down –0.03% from the day’s high of $107,775

-

Market movement:

-

BTC holds above the $107k zone with minimal volatility, signaling defensive sentiment

-

Market cap and trading volume remain high, indicating strong institutional support

-

-

Short-term trend:

-

If BTC maintains the $107k–108k support zone, a rebound toward $110k–112k is possible

-

A breakdown could lead to a correction toward $100k–105k

-

Trade Strategy

1. USD/JPY

-

Trend: Bearish

-

Strategy: Sell at 144.200, Stop Loss: 144.600, Take Profit: 143.400

2. Vietnam Stock: VNM

-

Recommendation: BUY VNM (July 1, 2025)

-

Entry range: 56,600 – 57,500 VND

-

Target 1: 60,000 VND, Target 2: 64,000 VND

-

Stop loss: 54,300 VND

Key Events Today (GMT+7)

-

20:30 – USD: Fed Chair Powell speaks

-

21:00 – USD: ISM Manufacturing PMI

JOLTS Job Openings

Disclaimer

-

The views expressed are solely those of analyst Leon from Lotus and do not constitute actual market advice.

-

Lotus only provides technical trading analysis and trading education.

-

Lotus does not represent any brokerage or asset management firm.

-

Lotus does not manage client funds.