News

Lotus Institute

Market Pulse 09/06: US Stock Market Soars, Gold Under Pressure, and New Prospects

Release Time: 10:00 AM on June 9, 2025

Issued by: Ms. Jenny

MARKET OVERVIEW

1. Stock Market:

- Vietnam Market: The market continued to weaken with increasing selling pressure, especially from foreign investors. Liquidity increased, indicating a return of supply, putting downward pressure on prices. Further correction is possible, as the market has not been able to break past the resistance zone of 1,345–1,350 points. The market is expected to find support at the 1,322-point level (MA20), which is the most recent bottom (June 2, 2025 session) and could trigger a recovery if buying demand returns.

- US Market: The S&P 500 rose 1.03% (reaching 6,000.36 points), the Dow Jones increased 1.05% (to 42,762.87 points), and the Nasdaq Composite climbed 1.02% (reaching 19,529.95 points). This upward trend was driven by a positive employment report, as the US economy added 139,000 jobs in May. Additionally, the trade deficit narrowed by 55.5% to $61.6 billion, showing an improvement in macroeconomic conditions. However, Tesla's stock fell 14.3% due to Trump-Musk tensions.

2. Foreign Exchange

- EUR/USD: Downtrend, today there may be opportunities for selling, daily resistance at 1.14450.

- USD/JPY: Uptrend, today there may be opportunities for buying, daily support at 144.000.

3. Gold:

- Current Price: $3,298.12/ounce, down approximately 0.4% (~$13) compared to the end of last week's session.

- Reasons for Decline: Optimism regarding US-China negotiations in London reduced safe-haven demand. Good US jobs data (139,000 jobs added – above expectations) made the market doubt the likelihood of an early Fed rate cut.

4. Oil:

- XTI/USD: Uptrend, today there may be opportunities for buying, daily support: 63.00.

5. Crypto: BTC

- Current Price: Approximately $105,692, almost unchanged from yesterday ($105,681).

- Short-term Trend: BTC is still slightly correcting within the fluctuation range of ≈$105,000–$106,000. Thanks to support from ETFs and large buying waves from "whales," the market potentially aims for $112,000 if it successfully breaks above the current resistance level.

ACTION PLAN

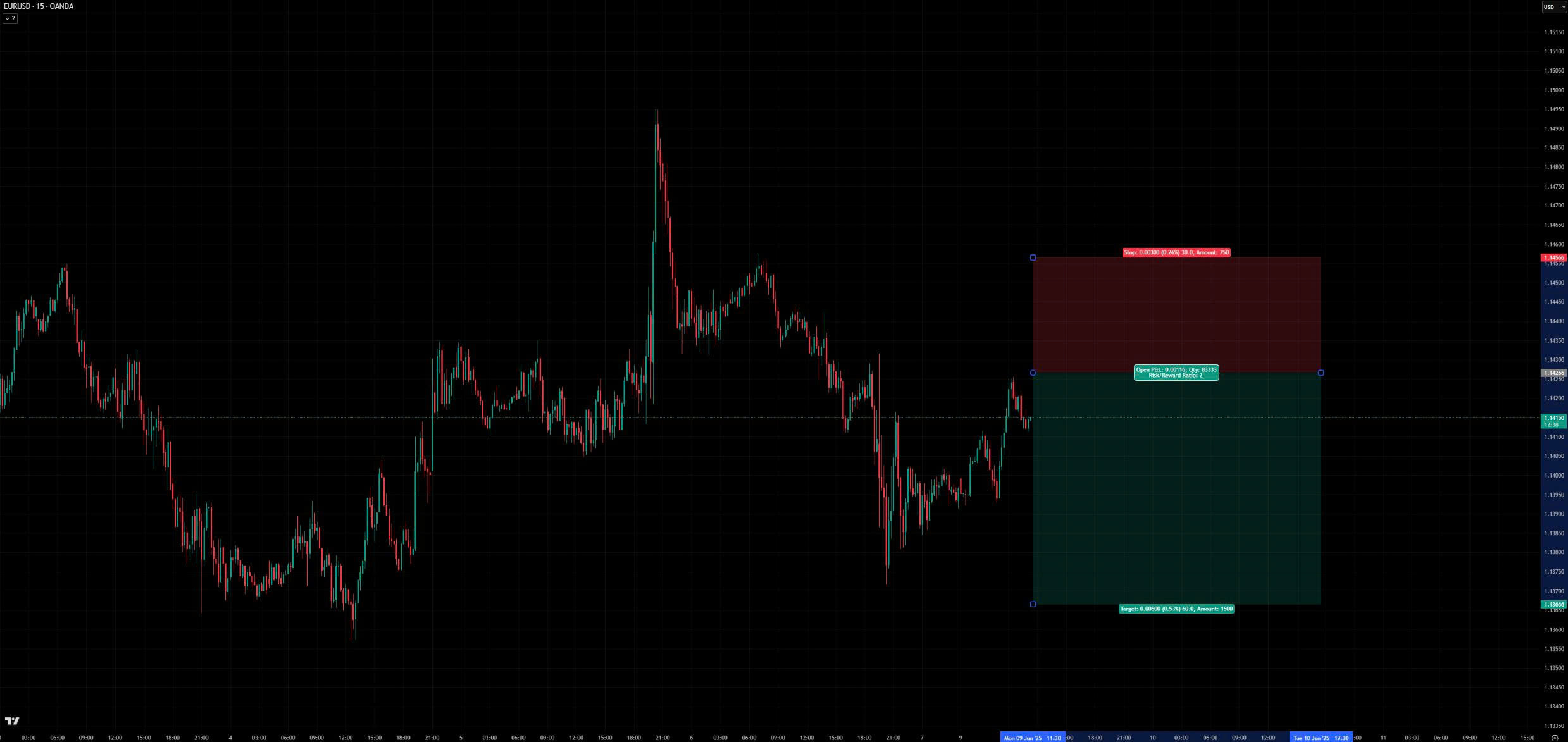

1. EUR/USD

- Trend: Downtrend.

- Strategy: Sell at 1.14266, stop loss: 1.14566, take profit: 1.13666.

2. XAU/USD:

- Trend: Recovery.

- Recommendation: Buy at 3308, stop loss 3293, take profit 3340-3360.

NOTABLE EVENTS TODAY

08:30 - CNY - Consumer Price Index (CPI) YoY

08:30 - CNY - Producer Price Index (PPI) YoY

Undetermined - CNY - New Loans

DISCLAIMER

The above analysis represents only the personal views of analyst Jenny from Lotus and should not be used as a basis for actual market participation.

Lotus only provides technical trading analysis and trading knowledge training for its students.

Lotus does not represent any securities company or asset management company.

Lotus does not manage students' funds.