News

Lotus Institute

Market Outlook for April 25, 2025 – Recovery Wave Expands, Uptrend Expectations Continue

Release Time: 10:00 AM, April 25, 2025

Publisher: Ms. Jenny

MARKET OVERVIEW

1. Stock Market:

-

Vietnam Market:

The market continued its recovery after the Dragonfly Doji signal on April 22, 2025. Decreased liquidity indicates reduced selling pressure and ongoing supportive cash flow. Although some volatility may occur around the MA(20) zone – 1,230 points, the recent two-day rebound strengthens the uptrend, with expectations of continued recovery in the near term. -

U.S. Market:

U.S. stock markets continued their strong rally for the third consecutive session on April 24, 2025, driven by positive earnings reports from major corporations and expectations of stable monetary policy.-

Dow Jones rose 1.2% to 40,093.40 points

-

S&P 500 gained 2% to 5,484.77 points

-

Nasdaq increased 2.7% to 17,166.04 points

-

Leading the gains were tech stocks such as Salesforce, Intel, and Nvidia, while IBM and Procter & Gamble declined due to underwhelming earnings results. Investors remain cautious due to ongoing U.S.-China trade tensions and potential new tariffs.

2. Forex:

-

EUR/USD: Downtrend – Consider short positions.

-

Daily resistance: 1.13800

-

-

USD/JPY: Uptrend – Consider long positions.

-

Daily support: 142.700

-

3. Gold:

-

Spot gold is trading at approximately $3,365/ounce, up $55 from the previous session’s low of $3,310/ounce.

4. Oil:

-

XTI/USD: Uptrend – Consider long positions.

-

Daily support: 62.60

-

5. Cryptocurrency: BTC

-

Bitcoin is currently priced at $93,557, slightly down from the previous session. However, this is seen as a corrective move, potentially setting the stage for the next upward leg.

TRADE PLANS

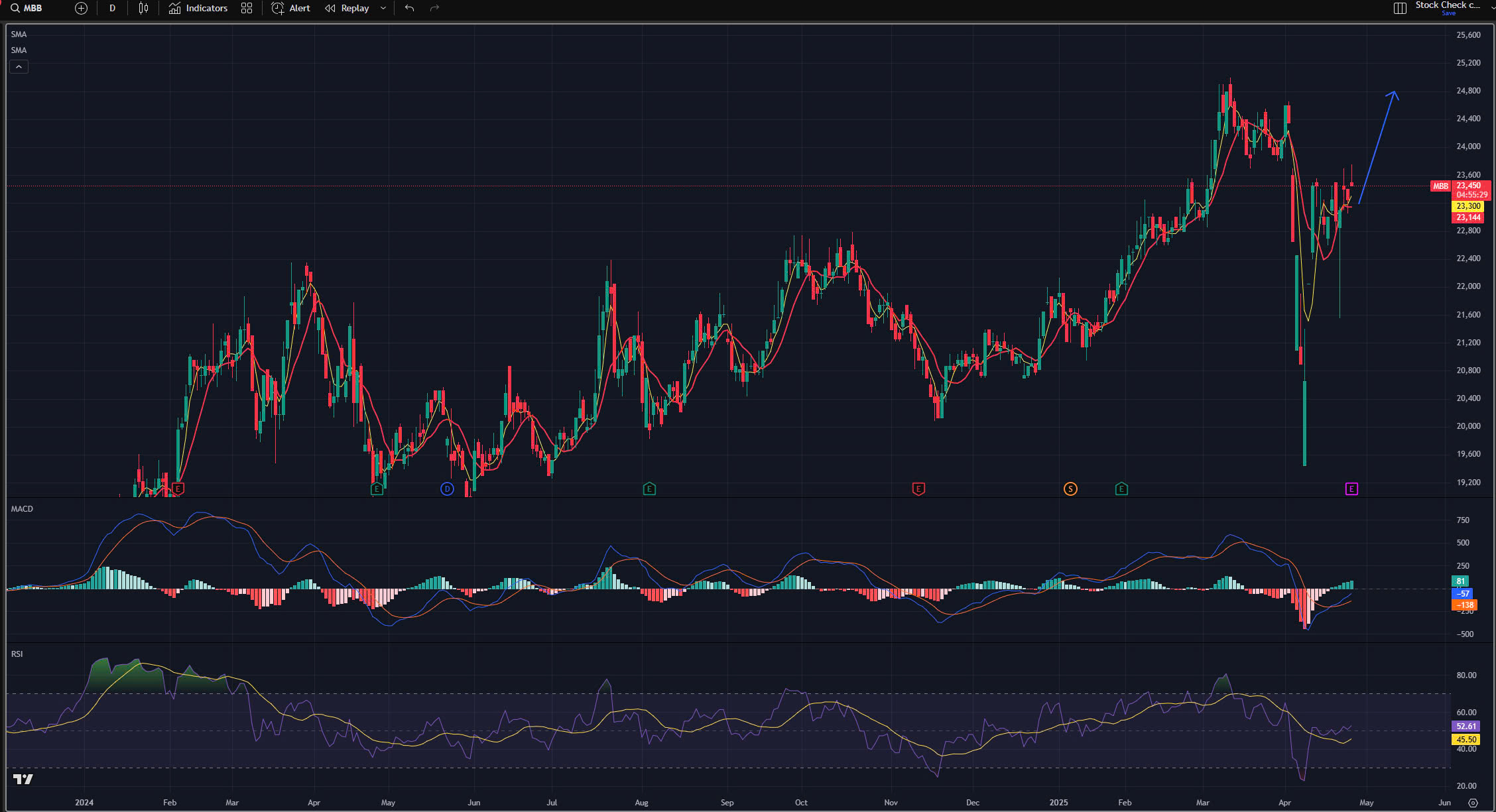

1. Vietnamese Stock: MBB

-

Recommendation: WAIT TO BUY MBB (April 25, 2025)

-

Entry range: 22,800 – 23,300 VND

-

Target 1: 24,700 VND

-

Target 2: 26,500 VND

-

Stop loss: 21,800 VND

-

2. XTI/USD

-

Trend: Uptrend

-

Recommendation: Buy at 62.8

-

Stop loss: 62.5

-

Take profit: 63.4

-

3. XAU/USD

-

Trend: Uptrend

-

Recommendation: Buy at 3348

-

Stop loss: 3306

-

Take profit: 3410–3435

-

KEY EVENTS TODAY

-

6:30 AM – JPY – Tokyo Core CPI y/y

-

1:00 PM – GBP – Retail Sales m/m

-

3:00 PM – CHF – SNB Chairman Schlegel Speaks

-

9:00 PM – USD – Revised UoM Consumer Sentiment

DISCLAIMER

-

The above analysis reflects only the personal opinion of analyst Jenny from Lotus and should not be used as a basis for actual trading.

-

Lotus provides technical analysis and trading education for learners.

-

Lotus does not represent any securities firm or asset management company.

-

Lotus does not manage money on behalf of learners.