News

Lotus Institute

April 22 Market: US Stocks Plunge – Gold Hits New High

Release Time: 10:00 AM, April 22, 2025

Publisher: Ms. Jenny

MARKET OVERVIEW

1. Stock Market

-

Vietnam Market:

The market continued to decline due to selling pressure from the end of last week but is temporarily supported around the 1,200-point level. Liquidity dropped, indicating cautious capital inflows. The recovery effort remains weak, and the market needs more time to test demand at this support level. In case of overselling, the next support level is at 1,185 points. The market is currently searching for a balance point after a period of high volatility. -

U.S. Market:

On April 21, 2025, U.S. stock markets continued to decline sharply due to concerns over trade policies and criticisms by former President Donald Trump towards Federal Reserve Chair Jerome Powell. The Dow Jones fell 2.5% to 38,170.41 points, the S&P 500 dropped 2.4% to 5,158.20 points, and the Nasdaq declined 2.6% to 15,870.90 points. Major tech stocks were sold off ahead of earnings reports. Meanwhile, both the U.S. dollar and government bond yields weakened. Gold prices surged to a record high as investors sought safe-haven assets amid rising economic and political uncertainties.

2. Forex Market

-

AUD/USD: Uptrend, recommended buy position today, support zone at 0.64166

-

EUR/USD: Uptrend, recommended buy position today, support zone at 1.14900

-

GBP/USD: Uptrend, recommended buy position today, support zone at 1.33770

-

USD/JPY: Downtrend, recommended sell position today, resistance zone at 140.900

3. Gold

Spot gold surged to a new record high of $3,417.62/oz, after hitting $3,430/oz during trading on April 21. This rally was driven by a weakening U.S. dollar and concerns over the economic impact of U.S.-China trade tensions, increasing demand for safe-haven assets.

4. Oil

-

XTI/USD: Overall uptrend, waiting for a breakout above 63.00 to enter buy positions.

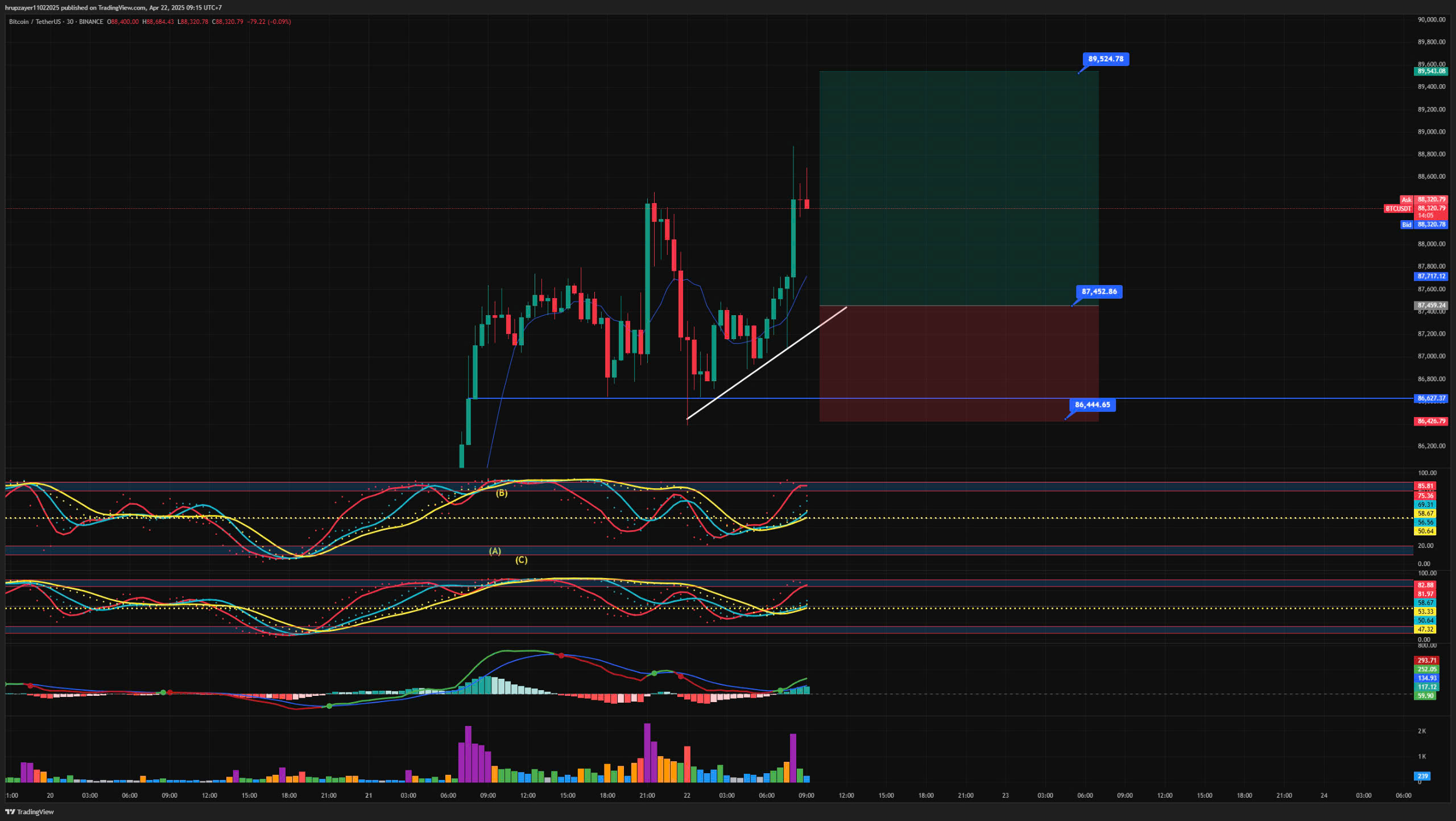

5. Crypto: BTC

-

Bitcoin is trading at $88,505, up about 1.42% from the previous session.

-

Intraday Range: $86,639 – $88,542

-

Market Cap: Around $1.678 trillion

-

24h Trading Volume: $20.70 billion

TRADE RECOMMENDATIONS

1. BTC/USD

-

Trend: Uptrend

-

Recommendation: Buy between 87,000–87,400

-

Stop Loss: 86,400

-

Take Profit: 89,000 – 91,000

2. AUD/USD

-

Trend: Uptrend

-

Recommendation: Buy at 0.64224

-

Stop Loss: 0.64124

-

Take Profit: 0.64424

KEY EVENTS TODAY

-

21:00 | EUR – ECB President Lagarde Speaks

-

21:00 | USD – Richmond Manufacturing Index

DISCLAIMER

-

The above analysis reflects the personal opinion of analyst Jenny from Lotus and is not intended as a recommendation for actual trading.

-

Lotus only provides technical trading analysis and educational training for learners.

-

Lotus does not represent any securities firm or asset management company.

-

Lotus does not manage learners' funds.