News

Lotus Institute

Financial Storm: Gold Surges Past $3,800, Bitcoin on Fire, Oil Loses Ground

Release Time: 10:00, September 30, 2025

Publisher: Mr. Leon

MARKET OVERVIEW

1. Stock Market:

-

Vietnam Market:

The market made efforts to climb and slightly broke above MA(20) at 1,663 points, although capital inflows remain cautious. Currently, the market is testing balance around MA(20); if buying power absorbs supply better, the uptrend will be reinforced. Otherwise, weak demand could trigger a correction once MA(20) is lost. -

U.S. Market:

On September 29, U.S. markets recovered modestly, led by technology stocks: S&P 500 gained ~0.3%, Nasdaq +0.5%, Dow Jones +0.1%. Capital is flowing into large-cap equities, while oil declined due to rising supply and cost-cut concerns. However, risks remain as a potential U.S. government shutdown could delay key economic data releases.

2. Forex:

-

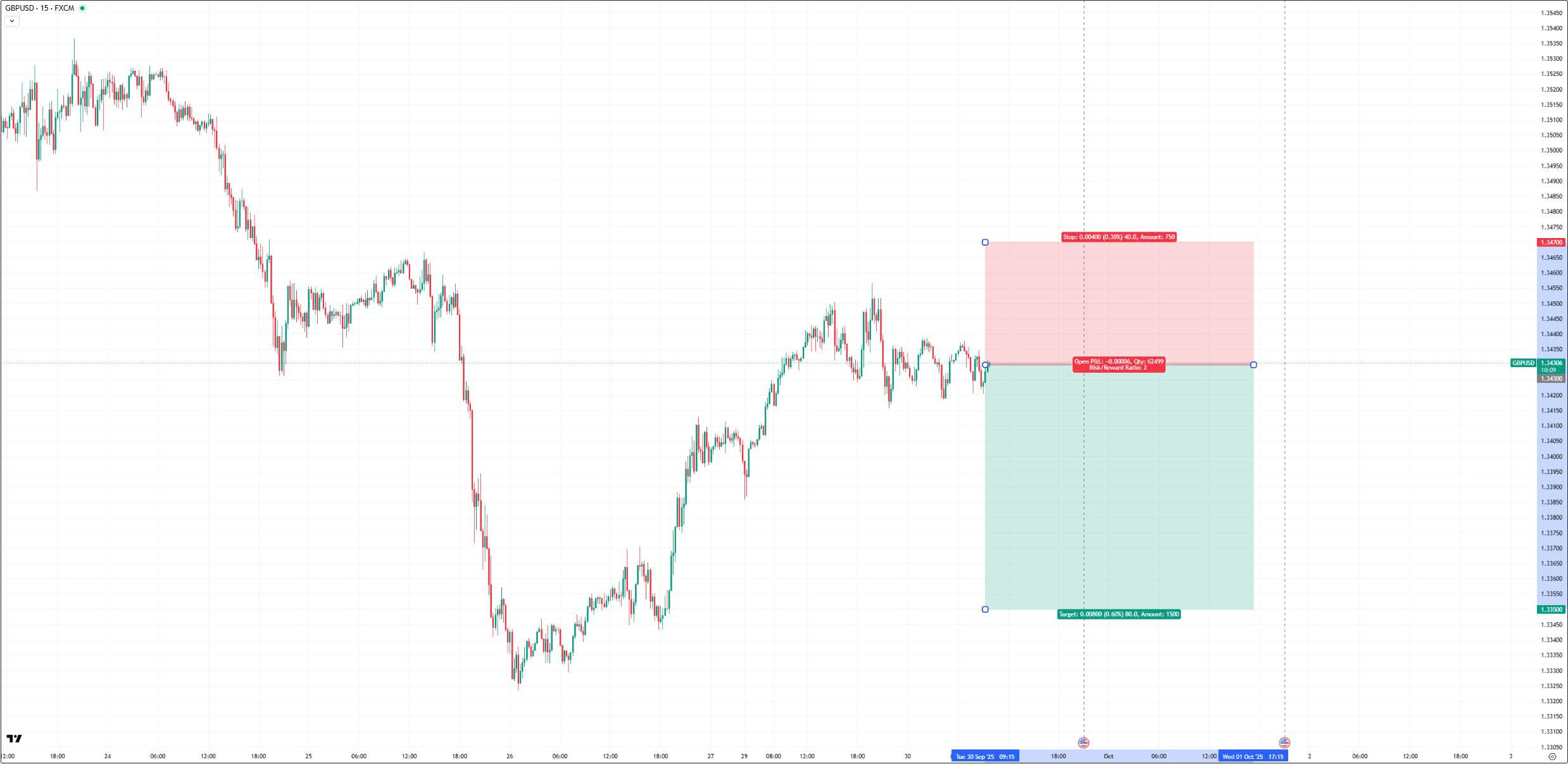

GBP/USD: Downtrend, short positions may be considered. Daily resistance: 1.34500.

-

USD/JPY: Uptrend, long positions may be considered. Daily support: 148.500.

3. Gold:

-

Gold hit a fresh high above $3,800/oz, closing at $3,829.63/oz, fueled by concerns over a possible U.S. government shutdown and expectations of further Fed rate cuts.

-

December gold futures also rose ~1.2% to $3,855.20/oz.

-

Main drivers: strong safe-haven demand amid a weaker USD and U.S. fiscal risk concerns.

4. Oil:

-

XTI/USD failed to rally and is now fluctuating within a limited trading range.

5. Bitcoin:

-

BTC trades around $114,549, up ~+2.547% compared to the previous session.

-

Daily range: ~$111,590 – $114,776.

-

Strong buying momentum is in play, with potential for further gains if supported by fresh capital inflows or positive macro news.

RECOMMENDATIONS

-

GBP/USD

-

Trend: Bearish

-

Sell at 1.34300, Stop Loss: 1.34700, Take Profit: 1.33500

-

WTI Oil

-

Trend: Bearish

-

Sell at 62.840, Stop Loss: 64.2, Take Profit: 60

TODAY’S KEY EVENTS

DISCLAIMER

-

The above analysis reflects only the personal views of analyst Leon from Lotus and does not constitute investment advice.

-

Lotus only provides technical analysis and trading education to students.

-

Lotus does not represent any securities company or asset management firm.

-

Lotus does not manage students’ funds.