News

Lotus Institute

Market Hot Spots 05/12: VN-Index Rises with Profit-Taking Pressure, Gold Indecision at $4,200, and US Labor Data

MARKET OVERVIEW

Release Time: 10:00, December 5, 2025

Issuer: Mr. Loki

1. Stock Market

Vietnam Market: The market maintains an upward trend, but strong contention has appeared due to short-term profit-taking pressure as prices move into resistance zones. Increased liquidity indicates investors are stepping up selling activity. However, supporting cash flow is still present, helping the recovery trend since 12/11 remain effective. In the short term, the market may continue to fluctuate, approaching resistance zones like 1,750–1,800 points. Still, if a pullback occurs, the 1,700–1,720 point area remains a critical support zone, which could help the market quickly recover.

US Market: US stocks closed slightly higher as investors awaited the week's jobs report. The S&P 500 rose by ~$0.2\%$, the Nasdaq rose by ~$0.3\%$, while the Dow Jones was nearly flat after a strong streak of gains. The 10-year Treasury yield dropped to around $4.17\%$, continuing to reflect expectations that the Fed will begin cutting interest rates from early 2025. In the stock groups, technology led the way on AI expectations, while financials and energy corrected. JOLTS data fell to $8.7$ million, the lowest in over three years, reinforcing the view that the labor market is cooling—a factor that gives the Fed more room to ease policy.

2. Foreign Exchange

USD/CHF: The main trend is sideways (ranging). Daily resistance is at 0.80450, and daily support is at 0.80000. A buy position can be entered when the price breaks above the daily resistance zone.

EUR/USD: The main trend is bullish (upward). Daily resistance is at 1.16600, and daily support is at 1.16000. A buy position can be entered when the price breaks above the daily resistance zone.

3. Gold

The price is trading around $4,205, attempting to hold just above the EMA 89 (the $4,202 area). After yesterday's sharp drop, Gold is trading sideways in a narrow range, showing extreme indecision. If it falls below the $4,200 area again, the Bears will trigger the next sell-off wave. Conversely, it needs to decisively break above $4,215$ to regain upward momentum.

4. Oil

XTI/USD: Bullish trend. Buy positions may be entered today. Daily support: 64.50.

5. Crypto

The price is at $92,576, undergoing a slight correction (pullback) after hitting the $94,000 resistance. The bullish structure is still maintained as the price remains well above the strong support line EMA 89 (the $91,548 area). This is an accumulation zone awaiting a new breakout, with no sign of a dangerous reversal.

RECOGNIZED PLAN

USD/CHF – Buy Stop at 0.80450, Stop Loss at 0.80200, Take Profit at 0.81000

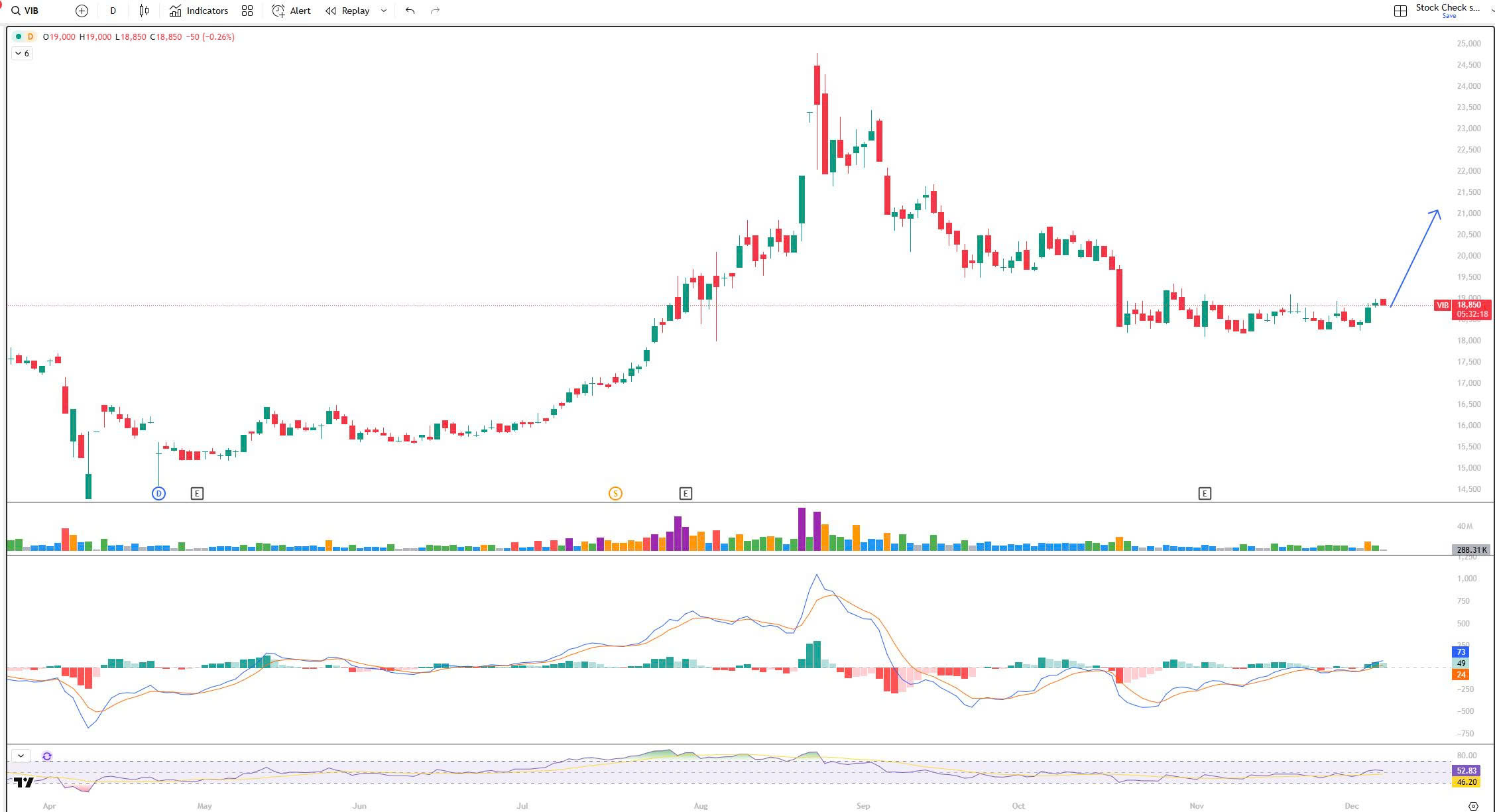

Vietnamese Stock: VIB

-

-

Recommendation: BUY VIB (06/12/2025).

-

Entry Price: 18,500 - 18,900 VND.

-

Target 1: 19,700 VND, Target 2: 21,500 VND.

-

Cut Loss (Stop Loss): 17,800 VND.

-

NOTABLE EVENTS TODAY

8:30 PM (Vietnam Time) - CAD:

-

Employment Change: Change is -1.5 thousand, compared to 66.6 thousand previously.

-

Unemployment Rate: 7.0%, compared to 6.9% previously.

10:00 PM (Vietnam Time) - USD:

-

Core PCE Price Index (m/m): 0.2%, unchanged from the previous level.

-

Prelim UoM Consumer Sentiment: 52.0, compared to 51.0 previously.

-

Prelim UoM Inflation Expectations: 4.5%.

DISCLAIMER

-

The above analysis represents only the personal view of analyst Loki of Lotus and is not a basis for actual market participation.

-

Lotus only provides technical trading analysis and trading knowledge training for its students.

-

Lotus does not represent any securities company or asset management company.

-

Lotus does not manage the funds of its students.