News

Lotus Institute

BITCOIN "SẬP HẦM" SAU BULL TRAP - CƠ HỘI BẮT ĐÁY CỔ PHIẾU PNJ & DẦU?

Release Time: 10:00, December 18, 2025 Issuer: Mr. Leon

MARKET OVERVIEW

1. Stock Market:

-

Vietnam Market: The market's recovery momentum is stalling as it faces resistance at the MA50 zone around 1,680 points, showing a slight pullback with decreased liquidity. This indicates caution from both supply and demand sides following a period of high volatility. The market returning to a probing state after approaching the 1,690–1,710 resistance zone is a normal development. This state may persist in upcoming sessions, potentially retreating to retest the crucial MA100 support zone; supply-demand dynamics during this test will determine the next market trend.

-

US Market: In the Dec 17 session, Wall Street witnessed widespread selling pressure led by Technology and AI stocks, dragging the market down. The S&P 500 fell approximately 1.2% to ~6,721 points, the Nasdaq Composite plunged ~1.8% to ~22,693 points, and the Dow Jones retreated ~0.5% to ~47,886 points due to valuation concerns and funding risks in the tech sector. This decline reflects increasing caution as investors reassess tech sector risks amidst a lack of supportive economic data.

2. Forex:

-

USD/CHF: Dominant trend is Sideways. Daily resistance: 0.79800; Daily support: 0.79300. Consider Long positions if price breaks the daily resistance zone.

-

USD/CAD: Dominant trend is Sideways. Daily resistance: 1.38000; Daily support: 1.37700. Consider Long positions if price breaks the daily resistance zone.

3. Gold: Price is moving sideways, accumulating around the $4,332 zone, sitting right above the short-term EMA support (blue line) at $4,328. The Bullish structure is maintained well. Buyers are not rushing to push prices up yet but are defending the support, indicating a sentiment of waiting for a new catalyst to break the peak.

4. Oil:

-

XTI/USD: Dominant trend is Sideways. Daily resistance: 57.20; Daily support: 55.90. Consider Long positions if price breaks the daily resistance zone.

5. Bitcoin: BTC's recovery effort has failed miserably. As soon as it touched the dynamic resistance EMA 89 (yellow line) at $87,147, the price was kicked back to the $86,499 zone. Selling force remains absolutely dominant. The Bulls seem exhausted after yesterday's "bull trap." The risk of breaking short-term lows to find lower price zones is very high.

RECOMMENDATIONS:

1. XTI/USD:

-

Buy Order: 56.80

-

Stop Loss: 55.50

-

Take Profit: 59.40

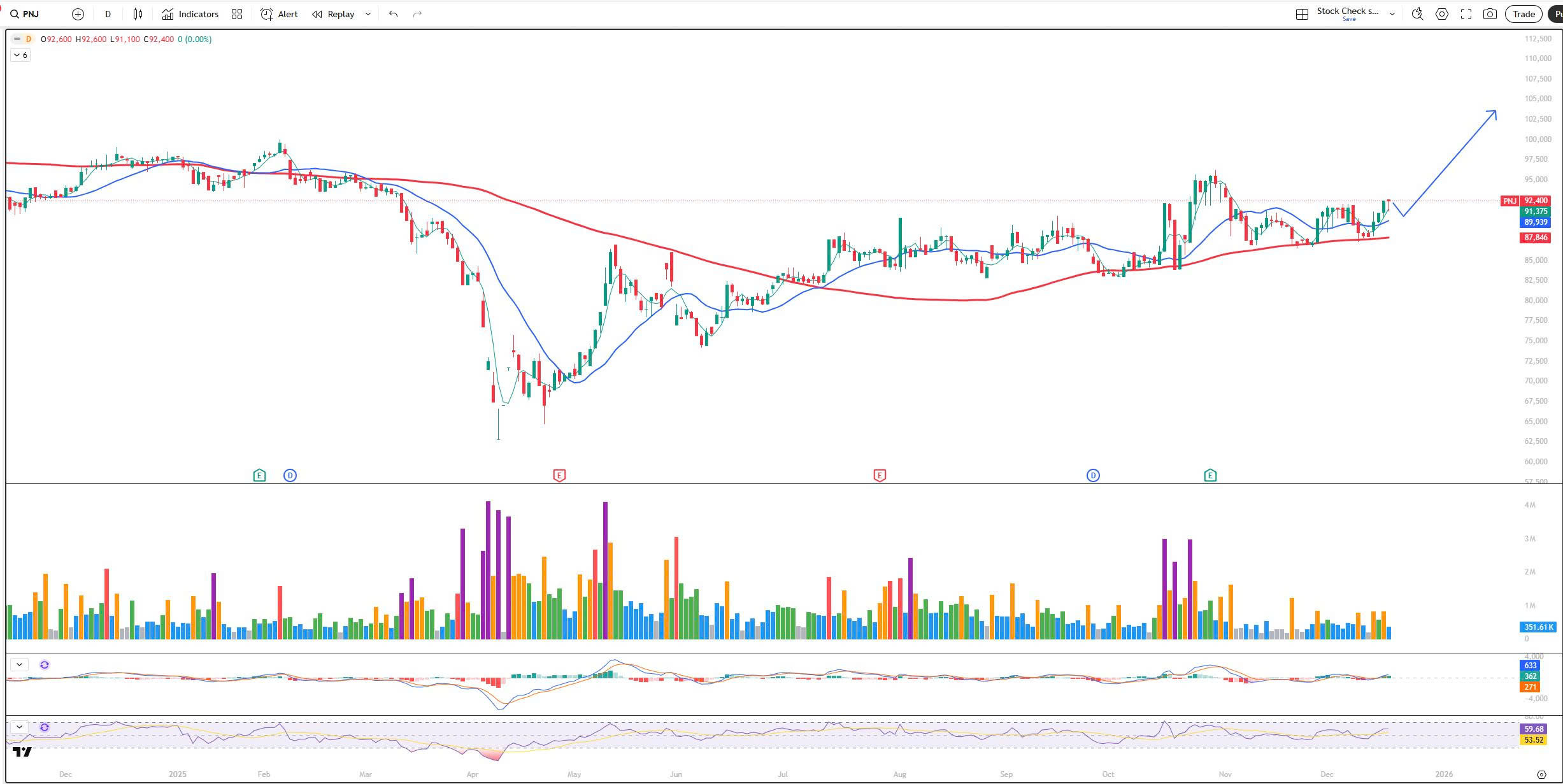

2. PNJ (Phu Nhuan Jewelry):

-

Buy Zone: 90,000 - 92,000 VND

-

Target 1: 98,000 VND

-

Target 2: 105,000 VND

-

Stop Loss: 86,000 VND

NOTABLE EVENTS TODAY:

DISCLAIMER:

-

The above analysis represents the personal views of analyst Leon from Lotus and does not constitute a basis for actual market participation.

-

Lotus only provides technical trading analysis and trading knowledge training for students.

-

Lotus does not represent any securities company or asset management firm.

-

Lotus does not accept capital management for students.